vermont income tax rate 2020

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Tax Year 2020 Personal Income Tax - VT Rate Schedules.

Here S How Much You Make On 200 000 Income After Taxes In All 50 States

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

. As you can see your Vermont income is taxed at different rates within the given tax brackets. Tax amount varies by county. 189 of home value.

Discover Helpful Information And Resources On Taxes From AARP. Ad Compare Your 2022 Tax Bracket vs. Vermont Tax Brackets for Tax Year 2020.

Vermont also has a 600 percent to 85 percent corporate income tax rate. The IRS will start accepting eFiled tax returns in January 2020 - you can start your online tax return today for free with TurboTax. 2020 New Jersey Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Vermont Income Tax Rate 2020 - 2021. Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. Vermonts income tax brackets were last changed two.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66. Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Compare your take home after tax and estimate.

An alternative sales tax rate of 6625 applies in the tax region Hoboken which appertains to zip. 1210 cents per gallon of regular gasoline 28 cents per gallon of diesel. 186 average effective rate.

RateSched-2020pdf 11722 KB File Format. Monday February 8 2021 - 1200. Vermonts rate schedules are designed to maintain at least 15 years of funding if no additional taxes are paid.

The Weehawken New Jersey sales tax rate of 6625 applies in the zip code 07086. Your 2021 Tax Bracket To See Whats Been Adjusted. Any income over 204000 and 248350 for.

Vermonts tax brackets are indexed for inflation. There are -923 days left until Tax Day on April 16th 2020.

Vermont Income Tax Vt State Tax Calculator Community Tax

Vt Dept Of Taxes Vtdepttaxes Twitter

Is Vermont Really So Expensive Vermont Public

Illinois 2022 Sales Tax Calculator Rate Lookup Tool Avalara

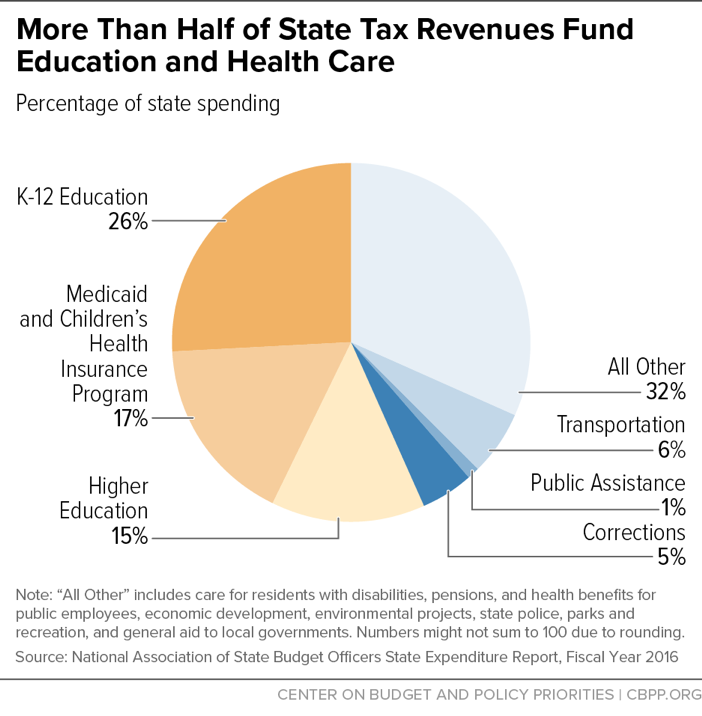

Policy Basics Where Do Our State Tax Dollars Go Center On Budget And Policy Priorities

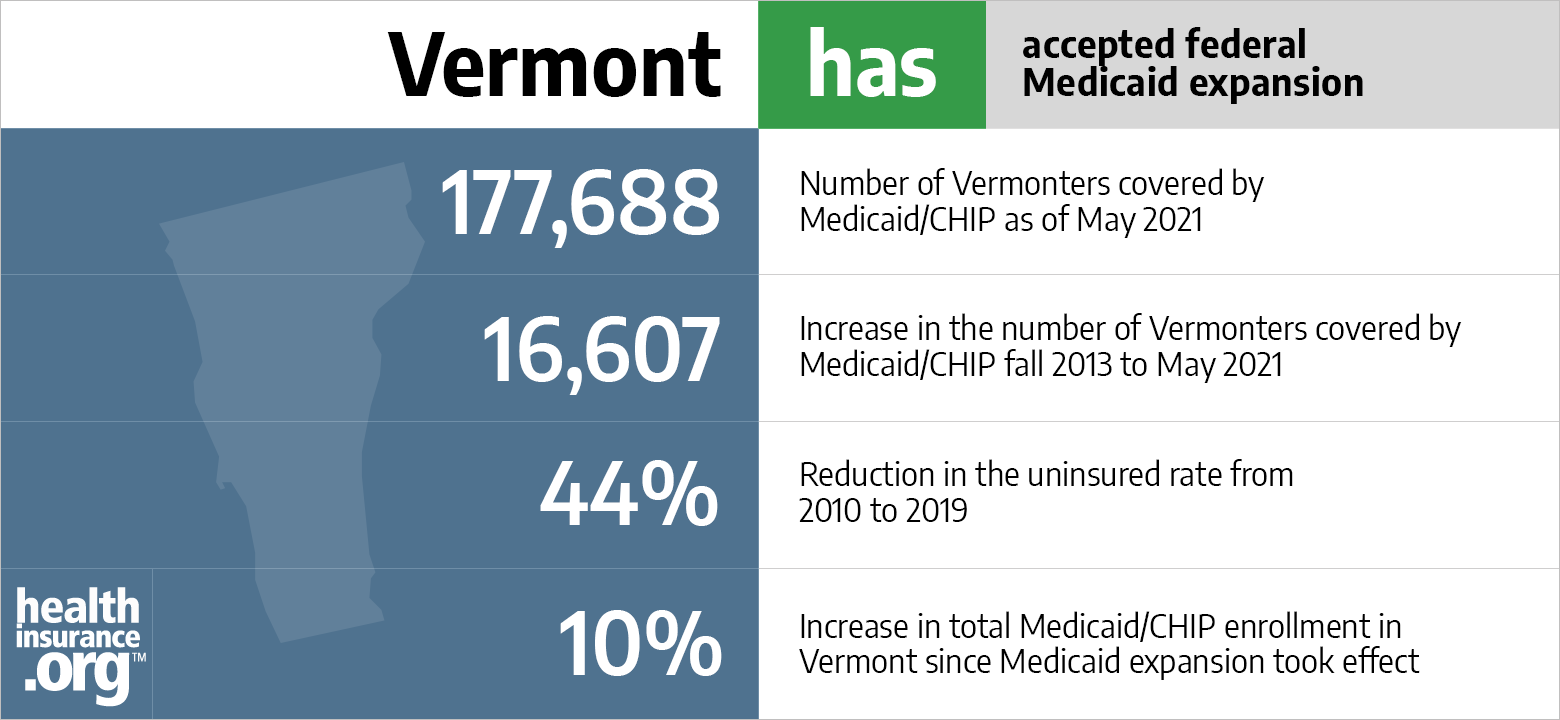

Aca Medicaid Expansion In Vermont Updated 2022 Guide Healthinsurance Org

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

Election 2020 State Health Care Snapshots Vermont Kff

Why International Businesses Want Vermont To House Their Captives Risk Insurance

Vermont Tax Brackets And Rates 2022 Tax Rate Info

Tax Rates To Increase Under School And Town Budgets Norwich Observer

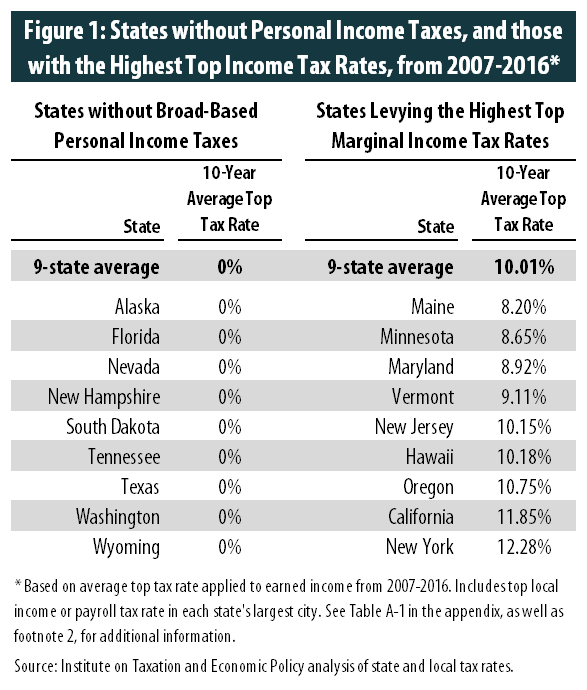

States Without Personal Income Taxes Are Not Seeing Greater Economic Growth Than States With Highest Income Tax Rates West Virginia Center On Budget Policy

Property Taxes Urban Institute

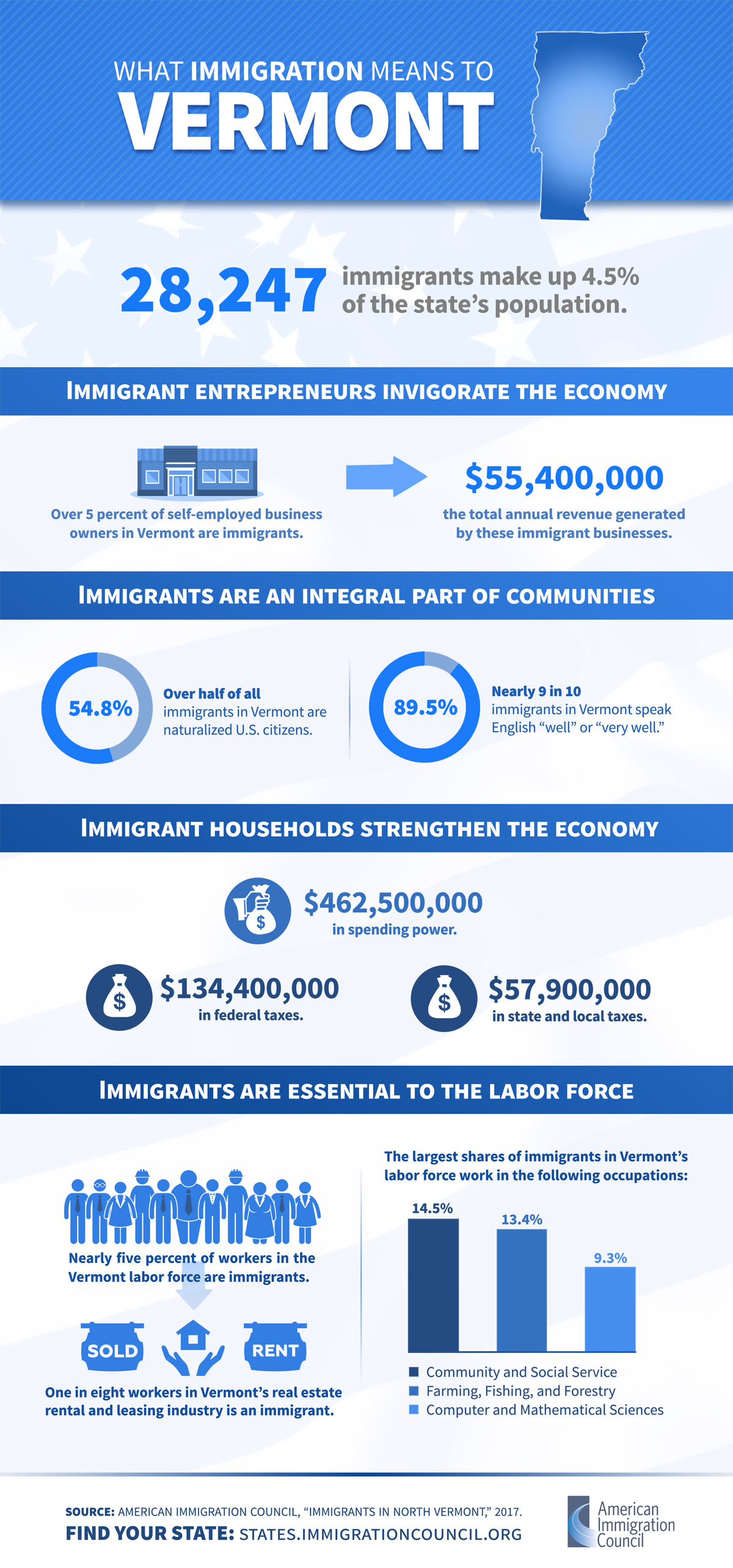

Immigrants In Vermont American Immigration Council

Vermont Housing Needs Assessment Reveals Racial Disparities Vhfa Org Vermont Housing Finance Agency

Taxation Of Social Security Benefits Mn House Research

What Students Need To Know About Filing Taxes This Year Money