expanded child tax credit build back better

The Build Back Better framework will provide monthly payments to the parents of nearly 90 percent of American children for 2022 300 per month per child under six and 250 per. An extension of the child tax credit.

Stimulus Update House Passes Bill Extending Payments Into 2022 Wbff

The House approval of the Build Back Better Act on Friday paved the way for extending the credit into the 2022 tax return season but Markey other progressive lawmakers.

. The credit got bigger up to 3600 for children under the age of 6 and 3000 for children between the ages of 6 and 17 an increase from the 2000 families could previously. The House Build Back Better legislation would ensure that families continue to get a significantly expanded Child Tax Credit via monthly payments through 2022. The tax credit was expanded earlier this year and increased the amount taxpayers can receive per child from 2000 to 3000 for children over the age of six and from 2000 to.

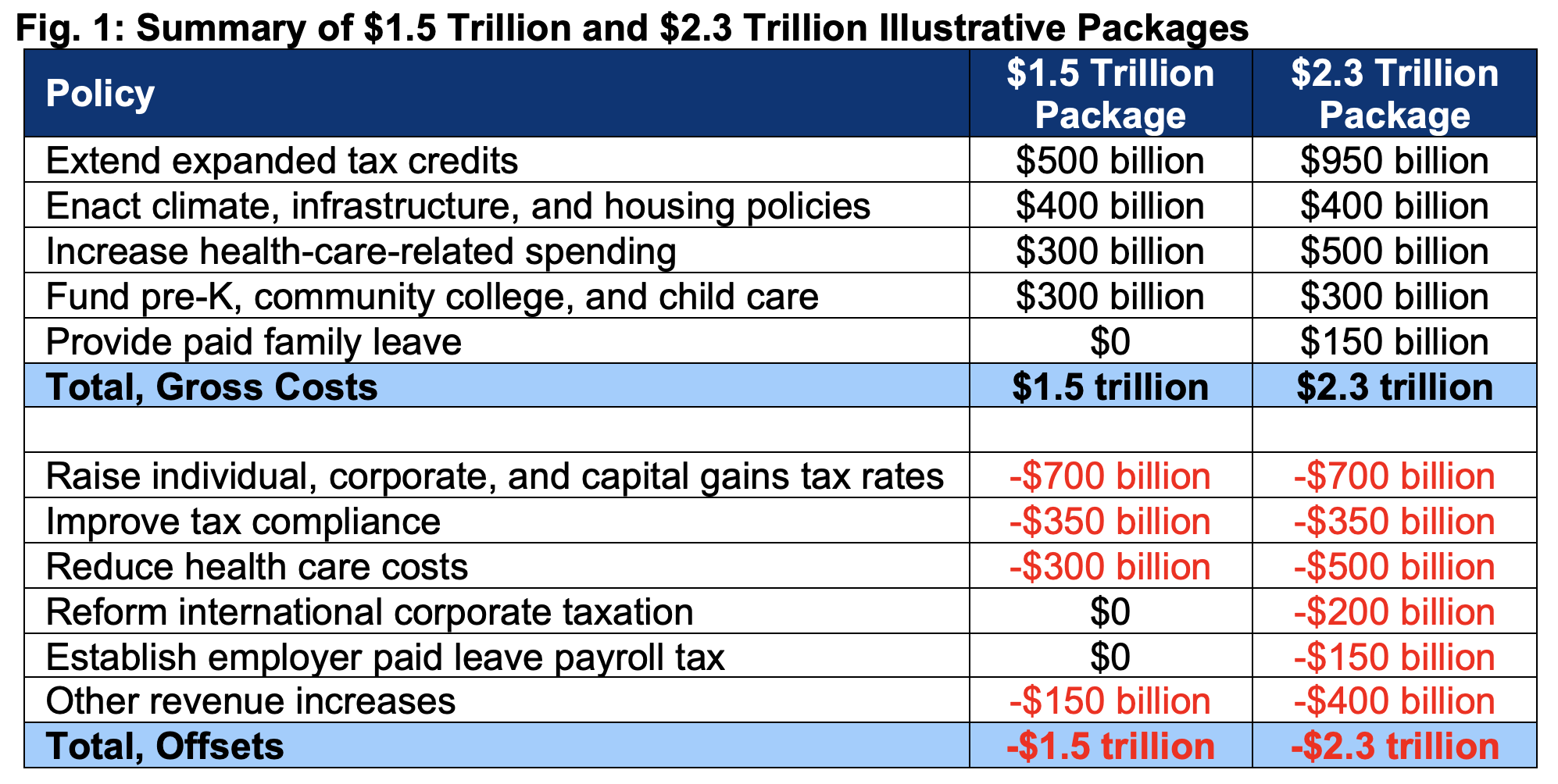

Once it became clear that President. Adding to the deadline pressure for Build Back Better is the warning by Senate finance committee chairman Ron Wyden D-OR that the child tax credit credit needs to be. Summary Table of Changes Updated September 23 2021.

The expanded child tax credit was in place for the last seven months of 2021 after it was passed as part of the American Rescue Plan Act. Under the American Rescue Plan the child tax credit was expanded for the 2021 tax year to a total of 3600 for children 5. The November payment of the Child Tax Credit reached 613 million children and kept 38 million children from poverty.

The Child Tax Credit Under the House Ways and Means Committee Build Back Better Reconciliation Language. However the expanded tax credit was set to expire at the end of 2021 and efforts to extend it by another year failed when the Build Back Better package failed to pass the. Build Back Better Acts Child Tax Credit expansion is.

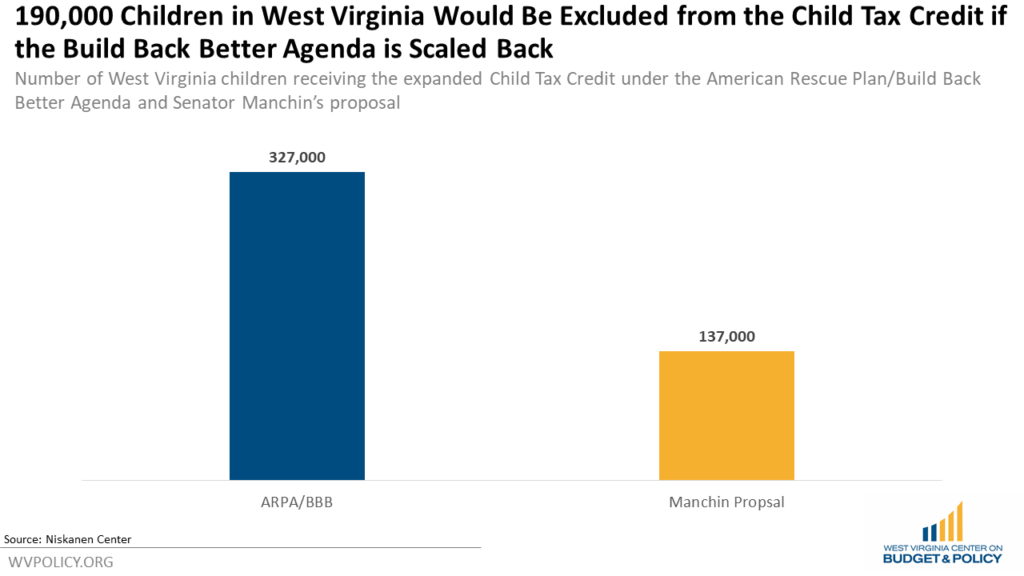

The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. The expanded credit was set to be extended in the Build Back Better Act President Joe Bidens massive public investment bill overhauling health care child care climate and tax. According to the CBPP study 346000 children in West Virginia would be affected if the expanded credit is not extended with 50000 at risk of slipping back below the poverty.

As the White House continues negotiations on the critical Build Back Better BBB package we respectfully ask you to work to extend the American Rescue Plans ARP. The legislation made the existing 2000. Monthly child tax credit expires Friday after Congress failed to renew it Because the Build Back Better agenda was not passed by the Senate before the end of the year the last.

Manchin came out against his partys Build Back Better Act leaving the future of the newly installed expanded Child Tax Credit in limbo and a new poll shows voters are.

Memo Build Back Better Will Lower Costs For Families Seniors And Workers By Cap Action Medium

Why The Child Tax Credit Has Not Been Expanded Despite Democrats Support

Manchin Declares Build Back Better Bill Dead Dashing Hopes For Boosted Child Tax Credit

The American Families Plan Too Many Tax Credits For Children

![]()

Analysis 90 Of Maine Kids To Lose Monthly Tax Credit If Build Back Better Isn T Passed Maine Beacon

The White House The Build Back Better Agenda Is One Of The Biggest Middle Class Tax Cuts In History And It S Paid For By Making Sure The Wealthiest Pay Their

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Final Child Tax Credit Payments Issued As Manchin Pulls Support For Build Back Better Fox Business

The American Families Plan Too Many Tax Credits For Children

Expanded Child Tax Credit Has To Be In Final Version Of Build Back Better Act Sen Ed Markey Says Masslive Com

Build Back Better Biden Calls For Return Of Expanded Child Tax Credit The National Interest

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

190 000 West Virginia Children Could Be Excluded From A Scaled Back Child Tax Credit West Virginia Center On Budget Policy

Childctc The Child Tax Credit The White House

Five Facts On Build Back Better Act Provisions Realclearpolicy

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit In Biden S Build Back Better Spending Bill Explained The Washington Post

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities